Insights & Regulatory Updates

FINRA Update on Crypto Asset Activities

On August 14, 2024, the Financial Industry Regulatory Authority (FINRA) issued an important update regarding its ongoing efforts to engage with its members on the subject of crypto asset activities. Referred to as "crypto assets," these are defined by FINRA as assets issued or transferred using distributed ledger or blockchain technology. These assets include virtual currencies, coins, and tokens, which may or may not meet the definition of "securities" under federal securities laws.

Former Broker Fined for Alleged Stock Hype in Client Emails: A Cautionary Tale for Advisors

On August 28, 2024, the Financial Industry Regulatory Authority (FINRA) announced the suspension and fining of Richard Joseph Jackson, a former broker, for allegedly engaging in misleading communications with clients regarding stock performance. This case underscores the critical importance of compliance with FINRA’s communication rules, particularly for financial professionals responsible for advising clients.

Court Denies SEC’s Request for Disgorgement in Ripple Case: Implications for Crypto Enforcement

In a notable development for the cryptocurrency regulatory landscape, a federal court has recently denied the Securities and Exchange Commission’s (SEC) request for disgorgement of profits in its case against Ripple Labs. This ruling, issued by Judge Analisa Torres of the US District Court for the Southern District of New York on August 7, 2024, marks a significant setback for the SEC’s efforts to impose substantial financial penalties in crypto cases primarily based on registration violations.

SEC Issues $24 Million in Whistleblower Awards: A Testament to the Power of Insider Cooperation

The Securities and Exchange Commission (SEC) continues to underscore the vital role that whistleblowers play in the enforcement of securities laws. On August 26, 2024, the SEC announced awards totaling more than $24 million to two whistleblowers whose information and assistance were instrumental in leading to successful enforcement actions, both by the SEC and another federal agency. This development is a compelling reminder of the significant public service provided by whistleblowers and the robust framework established to protect and reward them.

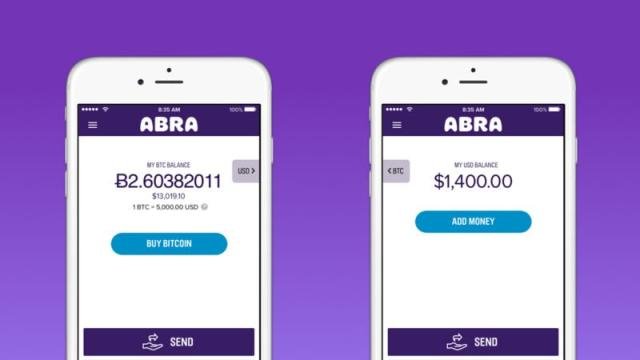

SEC Charges Abra with Unregistered Offers and Sales of Crypto Asset Securities

The SEC's recent enforcement action against Plutus Lending LLC, doing business as Abra, underscores the agency's unwavering commitment to ensuring that crypto asset offerings and sales comply with federal securities laws. The charges filed today highlight significant regulatory issues surrounding the unregistered offers and sales of crypto asset securities, specifically through Abra's retail crypto asset lending product, Abra Earn.

National Futures Association (NFA) Implements New Member Reporting Requirements

The National Futures Association (NFA) has introduced significant updates through Compliance Rule 2-52 and a corresponding Interpretive Notice. These new provisions, effective October 15, 2024, establish expanded reporting requirements applicable to all NFA Members, including those registered as commodity pool operators (CPOs) and commodity trading advisors (CTAs).

Top 10 Securities Enforcement Developments of Summer 2024

In this review, we highlight the top 10 securities enforcement developments of summer 2024, offering insights into the latest trends, landmark cases, and strategic shifts that are likely to influence compliance strategies and corporate governance moving forward. Whether you're navigating these issues in-house or advising clients, understanding these developments is essential for staying aligned with the evolving standards of securities law.

SEC Targets Standalone Investment Adviser in Groundbreaking Off-Channel Communication Enforcement Action

On April 3, 2024, the U.S. Securities and Exchange Commission (SEC) announced a landmark enforcement action against Senvest Management, LLC (Senvest), marking the first such action against a private fund adviser and a standalone investment adviser for failures related to off-channel communication recordkeeping. This case represents a significant development in the SEC’s ongoing enforcement efforts focused on recordkeeping failures in the financial industry.

Navigating New Risks: Key Insights from FINRA's 2024 Regulatory Oversight Report

The Financial Industry Regulatory Authority (FINRA) has recently issued its 2024 Annual Regulatory Oversight Report (the Report). This comprehensive 90-page document underscores evolving regulatory concerns and introduces several new areas of focus. Notably, the Report includes a dedicated section on cryptoasset developments and a detailed examination of market integrity topics, including the Securities and Exchange Commission (SEC) Market Access Rule.

FINRA Proposes Rules to Implement New Securities Lending and Transparency Engine (SLATE™)

On May 1, 2024, the Financial Industry Regulatory Authority (FINRA) proposed a new Rule 6500 Series to implement its Securities Lending and Transparency Engine (SLATE™). The new rule series is mandated by Rule 10c-1a under the Securities Exchange Act of 1934 (Exchange Act), which was adopted by the U.S. Securities and Exchange Commission (SEC) on October 13, 2023.

DOJ Announces New Pilot Program for Voluntary Self-Disclosures: What You Need to Know

The Department of Justice (DOJ) has introduced a new pilot program aimed at incentivizing individuals involved in corporate wrongdoing to voluntarily disclose information. This initiative, highlighted by Principal Deputy Assistant Attorney General Nicole M. Argentieri, underscores the DOJ’s commitment to enhancing accountability and uncovering hidden corporate misconduct.

California Law Firm Settles False Claims Act Allegations Over Misuse of PPP Loan Funds

On August 15, 2024, a California-based law firm, along with senior managers, agreed to a settlement totaling $274,000 to resolve allegations of False Claims Act violations related to the misuse of Paycheck Protection Program (PPP) loan funds.

New Corporate Whistleblower Awards Pilot Program: A Game Changer for Corporate Accountability

On August 1, 2024, Principal Deputy Assistant Attorney General Nicole M. Argentieri unveiled a significant new initiative: the Corporate Whistleblower Awards Pilot Program. This program represents a strategic enhancement to the Department of Justice’s (DOJ) enforcement capabilities and aims to fortify corporate accountability across multiple sectors.

Activist Short Seller Indicted for $16M Market Manipulation Scheme

On July 26, 2024, a federal grand jury in the Central District of California returned an indictment charging Andrew Left, a well-known activist short seller, with multiple counts of securities fraud. The indictment alleges that Left orchestrated a sophisticated market manipulation scheme that generated at least $16 million in illicit profits.

Advancing Financial Data Transparency: New Joint Standards Proposed by Financial Regulators

On August 2, 2024, Chair Gary Gensler announced a groundbreaking proposal aimed at enhancing the transparency and accessibility of financial data. This proposal, born from the Financial Data Transparency Act of 2022 (FDTA), represents a significant step toward standardizing financial data reporting across multiple regulatory agencies. The initiative involves nine financial regulators and is poised to streamline data collection and improve oversight efficiency.

Enhancing Financial Reporting: Insights from the Updated Conceptual Framework in FASB Standard Setting

On August 12, 2024, Paul Munter, the Chief Accountant at the SEC, released a statement emphasizing the significance of the recently updated Conceptual Framework for Financial Reporting issued by the Financial Accounting Standards Board (FASB). This comprehensive update, culminating with the issuance of Chapter 6, Measurement, of Concepts Statement No. 8, marks a pivotal moment in accounting standards development. As the FASB integrates these updates into its standard-setting activities, it's crucial for stakeholders to understand how these changes will shape the future of financial reporting and investor protection.

Understanding Conflicts of Interest in Artificial Intelligence: Video from SEC Chair Gary Gensler

On August 13, 2024, SEC Chair Gary Gensler released a video discussing the growing role of artificial intelligence (AI) in finance, particularly how it can introduce conflicts of interest that may impact investors. As AI becomes more integrated into financial services—from robo-advisors to brokerage applications—the potential for these conflicts to influence investment decisions and outcomes increases.

2024 Mid-Year Review: SEC Enforcement regarding Crypto Assets

The Securities and Exchange Commission (SEC) has been highly active in 2024, particularly in the enforcement of regulations within the crypto asset space. As the digital asset market continues to evolve, so too does the regulatory landscape. The SEC’s actions reflect its commitment to protecting investors and maintaining fair, orderly, and efficient markets, even in the rapidly changing world of cryptocurrencies.

Navigating the SEC Whistleblower Program: Guidance for Whistleblowers and Companies Alike

The SEC’s Whistleblower Program, established under the Dodd-Frank Act, plays a pivotal role in uncovering and addressing violations of federal securities laws. While it provides significant incentives for individuals to report wrongdoing, it also poses substantial risks and challenges for companies whose employees may come forward as whistleblowers. Understanding the program's intricacies and how it impacts both whistleblowers and companies is crucial for navigating these situations effectively.

Key Takeaways from SEC Report on Cyber-Related Frauds and Internal Accounting Controls

In today's rapidly evolving digital landscape, the threat of cyber-related fraud has become an ever-present concern for public companies. The SEC's 2018 report sheds light on this issue, focusing on the risks posed by cyber-related frauds that exploit vulnerabilities in internal controls. The report serves as both a cautionary tale and a guide for companies looking to strengthen their defenses against these sophisticated attacks.